The Auditing Standards were formulated by Auditing Standard Board of Institute of Company Secretaries of India and issued by Council of ICSI.

These Auditing Standards is effective from 01, July 2019 but on re commendatory basis , these are made mandatory from 01, April , 2020.

These standards are applicable for audit by Practicing Company Secretaries.

AIM OF ICSI AUDITING STANDARDS

It aims to support company secretaries to develop-

auditing acumen,

techniques and tools, and,

inculcate best auditing practices,

while conducting an audit.

PARTS OF AUDITING STANDARDS

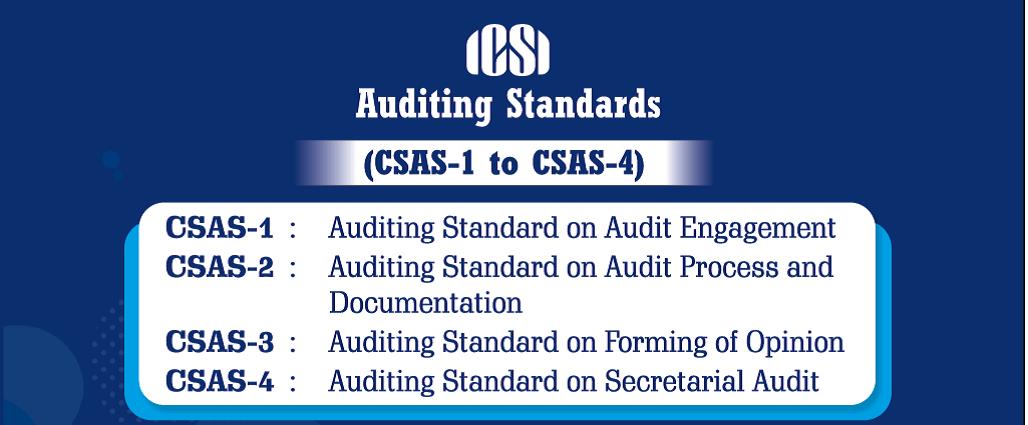

These ICSI auditing standards are divided into 4 parts:-

1. CSAS-1- Auditing Standard on Audit Engagement

2. CSAS-2- Auditing Standard on Audit Process & Documentation.

3. CSAS-3- Auditing Standard on Forming of Opinion.

4. CSAS-4- Auditing Standard on Secretarial.

CSAS-1-

AUDITING STANDARDS ON AUDIT ENGAGEMENT

It aims to support company secretaries to develop-

auditing acumen,

techniques and tools, and,

inculcate best auditing practices,

while conducting an audit.

PARTS OF AUDITING STANDARDS

These ICSI auditing standards are divided into 4 parts:-

1. CSAS-1- Auditing Standard on Audit Engagement

2. CSAS-2- Auditing Standard on Audit Process & Documentation.

3. CSAS-3- Auditing Standard on Forming of Opinion.

4. CSAS-4- Auditing Standard on Secretarial.

CSAS-1-

AUDITING STANDARDS ON AUDIT ENGAGEMENT

The Auditing standard on Audit Engagement deals with Auditor's roles and responsibilities with respect to Audit Engagement and the process of entering into agreement with the appointing authority for the purpose of audit.

Applicability- Audit Engagements accepted by the Auditor on or after 01, April, 2020.

AUDIT ENGAGEMENT PROCESS

Pre-Engagement Meeting- Before accepting the Audit Engagement, the Auditor shall have the pre engagement meeting with the Auditee to discuss terms of engagement, prior year audit findings and conclusions, appropriateness of legal framework, internal control system, commercial terms of Audit and timeliness and milestone , if any for conducting audit and submitting its report.

Appointment- The appointment of auditor shall be in accordance with applicable laws, acts, rules and regulations, standards and guidelines and if no manner is given, then by manner made by the Appointing Authority.

Certificate- The Auditor shall submit an eligibility certificate before accepting an audit ,which includes

a) The number of audits are within the ceiling limits by ICSI.

b) No substantial conflict of interest.

c) No restriction to render professional services.

d) He is not debarred to take audits in any other law,

Audit Engagement Letter- The Auditor shall obtain an Audit Engagement letter along with the copy of resolution and shall provide his acceptance to the appointing authority.

Communication to the Previous Auditor- The Auditor shall communicate with the previous auditor, in any before accepting the audit. Communication may be sent be registered AD , courier , by hand or by an email. Auditor shall wait for 7 days before accepting an audit.

ICSI has presribed following limits:-

Applicability- Audit Engagements accepted by the Auditor on or after 01, April, 2020.

AUDIT ENGAGEMENT PROCESS

Pre-Engagement Meeting- Before accepting the Audit Engagement, the Auditor shall have the pre engagement meeting with the Auditee to discuss terms of engagement, prior year audit findings and conclusions, appropriateness of legal framework, internal control system, commercial terms of Audit and timeliness and milestone , if any for conducting audit and submitting its report.

Appointment- The appointment of auditor shall be in accordance with applicable laws, acts, rules and regulations, standards and guidelines and if no manner is given, then by manner made by the Appointing Authority.

Certificate- The Auditor shall submit an eligibility certificate before accepting an audit ,which includes

a) The number of audits are within the ceiling limits by ICSI.

b) No substantial conflict of interest.

c) No restriction to render professional services.

d) He is not debarred to take audits in any other law,

Audit Engagement Letter- The Auditor shall obtain an Audit Engagement letter along with the copy of resolution and shall provide his acceptance to the appointing authority.

Communication to the Previous Auditor- The Auditor shall communicate with the previous auditor, in any before accepting the audit. Communication may be sent be registered AD , courier , by hand or by an email. Auditor shall wait for 7 days before accepting an audit.

Limit of Audit Engagement- The Auditor shall accept Audit Engagement with in the limits prescribed under any law being in force or by ICSI.

ICSI has presribed following limits:-

- 10 secretarial audits by PCS/partner

- An additional 5 audits by partner/PCS ,if unit is peer reviewed.

Conflict of interest- The Auditor shall not have any substantial conflict of interest with the auditee and any conflict of interest , other than substantial conflict of interest may be disclosed to the auditee.

The conflict of interest explained below shall not be constructed as substantial conflict of interest:-

- Auditor holding not more than 2% of paid up share capital or shares of value Rs. 50,000.

- Auditor indebted for an amount not more than Rs. 5,00,000.

- Auditor was in employment more than 2 years ago.

Confidentiality- The Auditor shall not disclose the information obtained during Audit without proper and specific authority or unless there is a legal obligation to disclose.

Changes in terms of Engagement- The Auditor shall not agree to a change in terms of employment without any proper justification.

If terms of engagement are changed, the Auditor and Appointing Authority shall agree to the new engagement by way of supplementary deed or any other suitable form in writing.

CSAS-2-

AUDITING STANDARDS ON AUDIT PROCESS AND DOCUMENTATION

It deals with the responsibilities and duties of Auditor with respect to process of conducting audit and maintaining proper documents including working paper files.

Objective- The objective of standard is to prescribe a Principle for an Auditor

1) Audit Planning- Audit Plan is very crucial and should be designed with due care. The Auditor shall prepare an audit plan, which shall include detailed layout for conducting audit procedures, timings, sample sizes basis of sampling, etc. Audit Planning involves establishing the overall audit strategy for the engagement and development of Audit Plan.

2) Risk Assessment- The Auditor shall evaluate high risk areas and activities of the Auditee with respect to :-

a) Internal Control System,

b) Transparency, prudence and probity,

c) Changes in the compliance team.

3) Information about the Auditee- The Auditor shall obtain sufficient information about the Auditee for conducting the Audit which may include:-

Objective- The objective of standard is to prescribe a Principle for an Auditor

- To conduct an audit as per the prescribed audit process.

- To maintain documentation that provide:

A : sufficient and appropriate records that form part of the Auditor's Report, and

B: evidence that audit was planned and performed as per applicable Auditing Standards ans statutory requirements.

1) Audit Planning- Audit Plan is very crucial and should be designed with due care. The Auditor shall prepare an audit plan, which shall include detailed layout for conducting audit procedures, timings, sample sizes basis of sampling, etc. Audit Planning involves establishing the overall audit strategy for the engagement and development of Audit Plan.

2) Risk Assessment- The Auditor shall evaluate high risk areas and activities of the Auditee with respect to :-

a) Internal Control System,

b) Transparency, prudence and probity,

c) Changes in the compliance team.

3) Information about the Auditee- The Auditor shall obtain sufficient information about the Auditee for conducting the Audit which may include:-

- Nature of business of Auditee,

- Sector in which the Auditee operates,

- Size of the business of Auditee,

- Media Reports

- Laws applicable to business of Auditee.

4) Audit Check-lists- The Auditor shall use systematic and comprehensive check list for carrying out the Audit and to verify the compliance requirement.

5) Collection and verification of Audit Evidence- The Auditor shall verify compliance with applicable laws, rules, regulations & standards. Any deviation shall be recorded.

6) Documentation- Documentation of Audit evidence supports audit conclusions and confirms that audit was carried out in the scope of audit. It shall take place through out the Audit process.

7) Record Keeping & Retention- The Audit document shall be collated for records within a period of 45 days from the date of signing of Audit Report and shall be retained for a period of 8 years from signing of such report.

CSAS-3

AUDITING STANDARD ON FORMING OF OPINIONS

Objective - Auditing Standards on forming of opinion deals with basis and manner of forming an opinion by the Auditor on the subject matter of the Audit and express his conclusion through the written report.

1) Process of Forming an opinion:- The Auditor shall consider materiality while forming its opinion and adhere to

- The Principle of Completeness

- The Principle of Objectivity

- The Principle of timeliness

- The Principle of Contradictory Process

2) Judgement, Clarification and Conflicting Interpretation- While forming an opinion the Auditor shall consider decided case laws, clarifications issued, opinions framed in similar type of Audit.

3) Precedence and Practices- Precedence and Practice in relation to Audit implies that Auditor shall evaluate on the basis of general and ongoing practice and procedure.

4) Form of an opinion- There are two types of opinion

a) Unmodified opinion- The Auditor concludes that

- Due compliance with applicable laws

- Records are free from misstatement

b) Modified opinion- The Auditor Concludes that

- Non Compliance of applicable laws

- Records are not free from misstatement

5) Format of Report- The Report shall be addressed to appointing authority unless otherwise specified in Engagement letter.

Signature block shall mention the name of the audit firm along with the registration number, certificate of practice number, whether ACS or FCS. The Audit Report shall be prepared in detail.

For any clarification or queries, drop email at shailja.tiwari16@gmail.com.